Membership Benefits

When you join the Deep Due Diligence Investors community you get access to over 50 highly engaged friends conducting due diligence on investments together. Our group likes to go DEEP, we read materials, go through PPMs, meet in-person with those raising capital, and vet opportunities together.

When you join the club you will first go through an initial due diligence training program put together by Marc Halpern, the head of the group. It is a 5 hour program that goes into depth on what to look for, ask about, and keep in mind while conducting due diligence.

You will also gain access to a private forum where you can connect with members, review deals under due diligence, ask questions, and see upcoming live events. We have 30 live events a year to choose from featuring angel investors, ultra-wealthy investors, decamillionaires, centimillionaires, pro athlete investors, and other speakers ranging from 50-400+ people in size each. We hope out of 30 events a year you can attend 4-7 of them and bring a spouse or child with you if you wish. The events are hosted in Dallas, NYC, Beverly Hills, and Fort Lauderdale. The group is a lot of fun but it is only for those serious about conducting serious, deep due diligence on potential deals.

Finally, you will also be able to access our proprietary artificial intelligence tool, the Deep Due Diligence Co-Pilot, which helps you quickly assess any pitch being made to you within the club or outside of it. This AI tool is trained on 150 due diligence resources, checklists, whitepapers, and training sessions and will always uncover additional red flags, risks, and smart questions to consider asking.

So when you join you get connected to a group of deep due diligence friends, a forum, 30 live events a year (of which we hope you can attend 4-7 of), and the artificial intelligence tool for due diligence.

If that sounds like you click here to get started.

Requirements & Expectations for Members

In order to maintain the high quality of our group, every member must first complete the training program by Marc Halpern called “High-Return Private Placement Investing: Best Practices & Risk Management.” Also, every member must abide by certain standards of behavior.

- Respect & Conduct – Members must be respectful of other members in all communications and activities. No solicitation for capital, services, solutions, or consulting is allowed and is grounds for removal from membership.

- Personal Responsibility – It is the responsibility of each member to monitor the communication platform for information about PPOs, meetings, and collaborative activities. Do not expect or rely on others to spoon-feed or remind you of PPOs or meetings. Our activities are to be considered as active self-help.

- Deep Due Diligence (DDD) Requirement – Members MUST ACTIVELY and PERSONALLY perform Deep Due Diligence on a PPO in which they invest. To be more explicit, members cannot join the group with the intent of piggybacking their investing in PPOs in which other members invest without ACTIVELY and PERSONALLY performing Deep Due Diligence themselves on that PPO. Active and personal contributions to the DDD process by members are documented as written input in DDD documents for a specific PPO. Members must not rely on the DDD or opinions of other members when making their own investment decisions.

- Team Formation – Teams form organically; they are not assigned. If a member wants to join a team or form a team, it is the member’s responsibility to form or join a team.

- Investment Responsibility – Since each member is required to actively and personally engage in the Deep Due Diligence process for any PPO in which they invest, and since each member makes their own independent investment decision, the investment performance of that investment is the full and sole responsibility of that member. No member, no DDD team, and none of the group’s leadership is responsible or even partially responsible for the investment performance of any other member. Members agree to hold harmless and indemnify fellow members from any claims, losses, or liabilities arising from investment outcomes that do not meet expectations.

- Contribution to the DDD Process – Members are expected to contribute to the Deep Due Diligence process for any PPO in which they invest by posting written input, including questions for sponsors, on the communication platform and in DDD documents that are created for a specific PPO (sometimes a Google Doc).

- Non-Disclosure Agreements (NDAs) – Members should expect that in some cases a non-disclosure agreement (NDA) may need to be signed individually in order to gain access to information for certain PPOs. A team leader cannot sign an NDA on behalf of another member. In such cases where an NDA is required, the due diligence communications will be conducted in private forums established to evaluate that PPO.

- Optional Participation – A member is not required to participate in any DDD for any PPO unless the member invests in that PPO. In other words, there is no commitment of time or effort by a member to actively participate in DDD when the member has no available funds for investment and/or has no interest in any PPO being reviewed.

- Investment Philosophy – Our members’ approach to investing aligns with Rob Skalski’s motto:

“Make Friends, Make Money, In That Order.” - Engagement Expectations – Each member is expected to attend or live-stream 2-4 events a year and participate in the online forum that comes with membership and is exclusive to members.

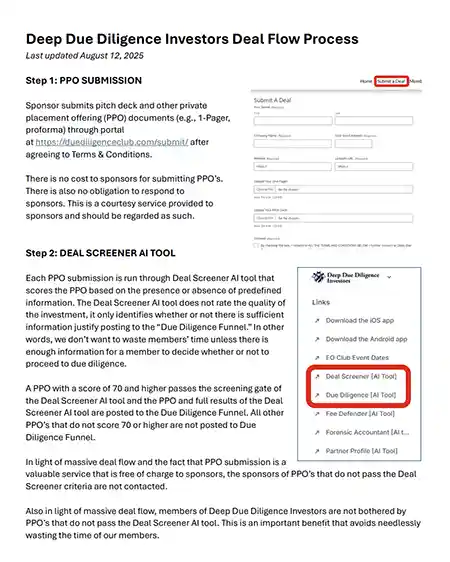

Deep Due Diligence Investors Deal Flow Process

Deal Submission Process:

Before a new deal appears on our platform, every capital raiser must go through the detailed vetting process outlined in the document to the right. This process ensures that only offerings with sufficient, well-presented information make it through our AI-powered screening and into the Due Diligence Funnel. By reviewing these steps, you’ll see how submissions are filtered, how due diligence teams form, and how we safeguard your time by only presenting opportunities that meet our minimum information standards. This upfront screening helps maintain the quality of deals you see and ensures your attention is focused on offerings worthy of deeper consideration.